The news of Omicron Covid-19 variant, announced in the midst of the ‘Golden Quarter’, has set the tone for an uncertain Christmas and new-year. As the last two years of Covid-related restrictions has completely upended the way consumers use public spaces.

To understand the public’s interactions with spaces and places and to better understand if the arrival of Omicron has altered consumers’ behaviours. VI looked at this year’s Black Friday – a key retail period for the Golden Quarter.

Using Oxford Street East, the UK’s busiest high street, over the Black Friday period from 26th – 30th November 2021, there were 760,000 visits; well above the previous year which saw 325,000 visits over the same period. Seemingly, there is still a strong appetite for physical retail and real-life experiences despite new Covid concerns. However, visitor numbers still haven’t fully rebounded to the pre-Covid level with visits to Oxford Street over Black Friday 2019 coming to 2.2m, 65% more than in 2021.

Digging deeper into the data, over the 2021 Black Friday period, 80% of all visitors to Oxford Street were repeat shoppers, having returned on a monthly basis. Conversely, over the same period in 2020, only 2.5% of visitors were monthly shoppers, with the bulk of visitors coming less frequently: either quarterly, half-yearly or annually. The data for 2019 also follows a similar pattern. This indicates that currently there are a core set of consumers dedicated to regular shopping trips; perhaps undeterred by the renewed threat of Covid. In previous years (2019 and 2020) our data suggests that consumers made the journey to Oxford Street far less frequently, perhaps only visiting for special occasions or one-off shopping trips.

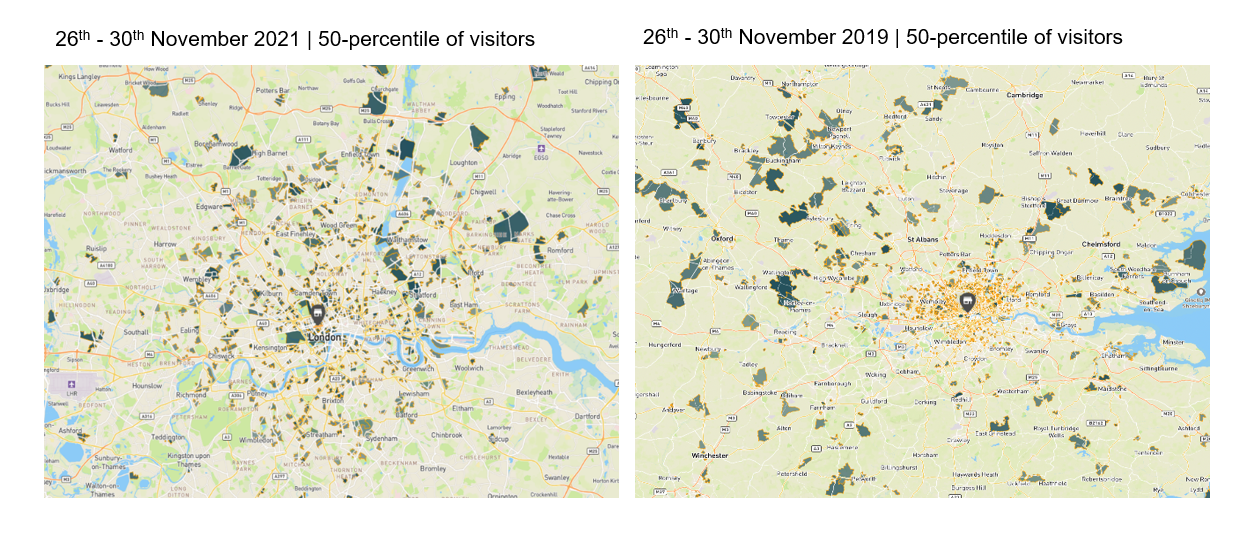

Indeed, we can also see that the top 50th-percentile of visitors over the 2021 Black Friday period has actually come from London, the majority within a 30minute drive-time. Whereas looking at the catchment for visitors for the same period in 2019 we can see a much wider geographical spread.

What does this all mean for retail in the UK?

Well, despite the renewed threats from Covid, uncertainty around lockdowns, and economic and inflationary pressures, visits, at least to Oxford Street seem rather robust. Although in pure visit numbers 2021 doesn’t yet reflect 2019 levels, they are however up on 2020 levels. And seemingly there is a dedicated group of consumers making regular journeys into the West End. This may not necessarily equate to conversion and spending, and the much-anticipated trading results for The Golden Quarter and Christmas may paint a very different picture. Yet, if visit numbers and repeat visits are anything to go by, at the very least, prime shopping destinations seem to be fairly resilient.