Selfridges has announced that it is in acquisition talks with the Qatar Investment Authority (QIA). The Weston family, who took the department store private in 2003 for £598m, has launched the auction process, pricing the business at a minimum of £4bn. The sale includes Selfridges’ department stores in Dublin, Birmingham and Manchester.

If the deal were to go through, it would mark the QIA’s second acquisition of a London department store; having acquired Harrods back in 2010.

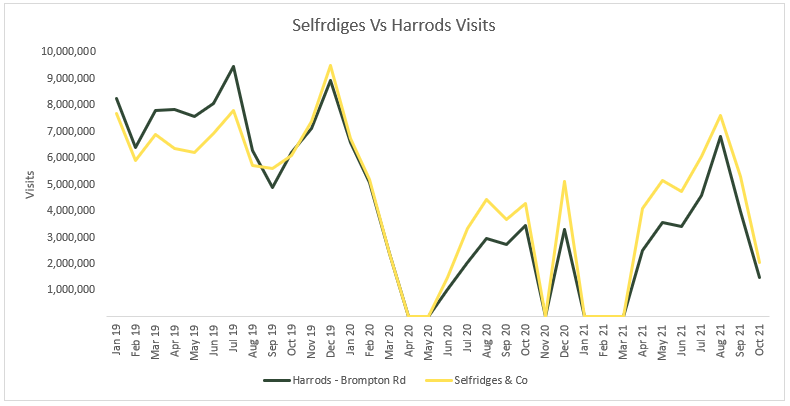

VI decided to look at footfall across Selfridges and Harrods’s respective London flagship stores from January 2019. For both Selfridges and Harrods, year-on-year footfall from January through October this year was up by 22% and 11%, respectively. Visits to Selfridges over the YTD period came to c.34m, while visits to Harrods amounted to c.28m.

When compared to the same period in 2019, however, footfall is still significantly depressed. Selfridges’ footfall is down by 43% compared to pre-Covid levels, whilst Harrods’ footfall is still down by 62% over the comparative YTD period.

An acquisition of Selfridges has clear synergies with QIA’s current London retail portfolio, and based purely on footfall, Selfridges seems to be the more resilient of the two. If successful, the acquisition would certainly bolster the QIA’s grip on the luxury retail market within the UK.