5TH – 11TH DECEMBER

Hospitality is historically a strong performer during the holiday period. So, for the last VI Christmas Consumer Index of 2022 we are going to look at the Pubs, Bars and Inns sector – our platform allows us to dive into specific sectors and analyse trends and brand performance and easily extract some unique insights.

We’ve looked at data over the festive period since the start of the World Cup with the week beginning 21st November, the day of England’s opening match.

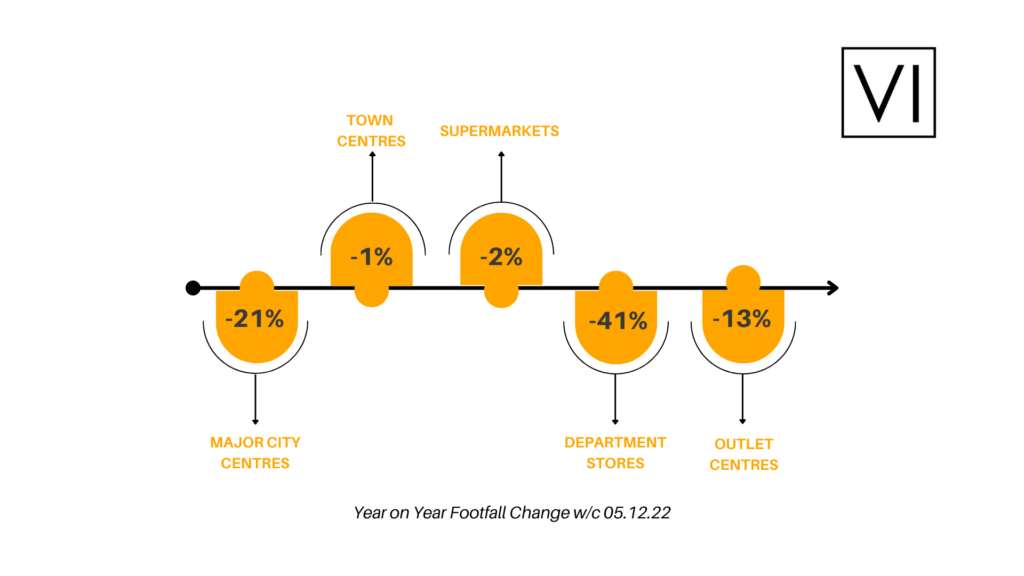

We wrap up our 2022 retail focus with this week’s updated Year on Year performance of the five major Benchmarks:

Aberdeen returned to the top this week, seeing the highest YoY increase in footfall last week with a 2% increase. Whilst city centres are struggling YoY, there continues to be encouraging signs of WoW increase – such as Southampton (31%) and Bristol (15%).

Town centres had minor decreases – the first signs of struggle after a strong festive period thus far. Supermarkets have slipped into the red for the first time since the CCI began, however Aldi (16% YoY) and Lidl (23% YoY) continue to perform well.

There were further signs of encouragement for department stores despite the poor looking YoY figure. Harrods and Selfridges both saw 11% increases in footfall from last week.

Outlet centres showed the most promising trends since the first week of the CCI with a 13% decrease. Junction 32 and Lakeside Village have both managed an increase in footfall YoY, reversing declines of more than 20% last week.

Holiday Hospitality Results

81,000,000 Total Market Visits

With thousands of locations identified the UK, visits across the sector are up almost 10% compared to the same timeframe a year prior. This strong performance can be contributed to the majority of brands allowing their pub managers to screen the football.

Wetherspoons still maintaining grip on the market

While recent headlines on Wetherspoons have been despondent with their announcement of 39 pub closures across the UK, they still have maintained a firm grip on a majority share of the market. Their share of visits across the sector, during this period, increased by 3% However, it’s total market share has actually decreased, also by 3%. So, whilst all brands are benefitting in a strong festive performance for the Pubs, Bars and Inns sector, some are seeing their total market share strengthen more than others.

Other Major Players in the Market

Greene King: the second-largest brand has seen a huge 30% increase in footfall across its sites. This equates to an 18% increase in its market share. The third-largest brand, Stonegate, has witnessed a 7.5% increase in visits across its pubs. However, with their acquisition of the Ei Group, we are working to integrate our platform with their now expansive portfolio to accurately reflect their standing. Another acquisition that made the headlines was Asahi’s purchase of Fuller’s entire beer business and shifting Fuller’s focus to the operation of their over 300 pub and hotels representing a 5% share of the overall market.

So, the hospitality industry looks to be finishing off the year with another strong performance – encouraging following Covid-19. With the World Cup now over and Christmas around the corner, how will pubs fare throughout the traditionally leaner winter months in 2023?