This week’s spotlight focuses on Joules, who have been rescued from administration by Next, saving around 100 stores and 1,500 jobs.

Will this prove to be an astute purchase for Next, who are fighting the doom-and-gloom surrounding retail having recently snapped up Made.com IP just weeks ago?

Has Joules been a brand in decline over the past few years, and has recent news rejuvenated consumers love the for the brand? Has the brand seen reduced visits, or did rising costs and inflationary pressures lead to administration?

21st – 27th November

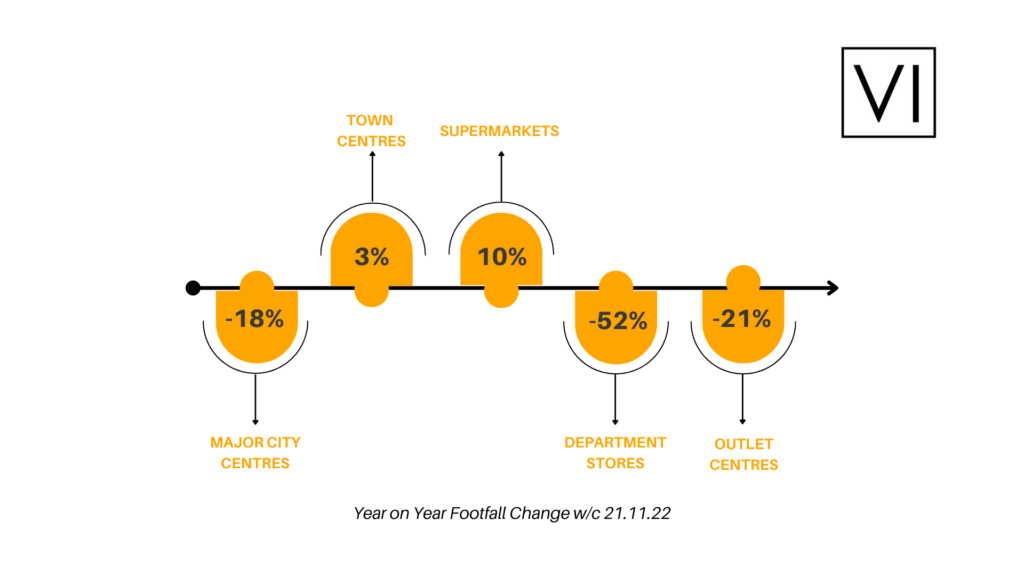

Aberdeen remains the most resilient city centre this week, but the largest week-on-week increase in footfall was in Nottingham – the city saw an uptick of 11% in visitors. This is well above the average week-on-week figure of -2%, which is a more positive sign for UK major cities than YoY figures.

Town centres continue to perform well post-pandemic, with a shift in preference for local shopping showing no signs of abating.

Supermarkets continued exhibiting increases in footfall from last year, albeit this week not as impressive as last. Lidl overtook Aldi as the supermarket with the biggest YoY change, with a 36% YoY increase: further signs that consumers are opting for a financially-friendly brand for Christmas shopping.

Department stores and outlet centres continued showing poor performance. However, outlet centres can take comfort in seeing that Dalton Park, County Durham has managed to reverse its poor fortunes; last week experiencing a 27% YoY increase.

WEEKLY SPOTLIGHT

WHAT’S NEXT FOR JOULES?

Joules has shown strong resilience in 2022, with visits to the brand’s stores steadily increasing month-on-month. Visits are above pre-pandemic levels, with a strong upwards trajectory from April 2021.

Visits last week increased 24% YoY, and this is much stronger performance than Next, Fat Face, White Stuff and GAP – the latter two had decreased in footfall.

Consumers interactions with Joules and Primark have become more intertwined. Last week, Joules and Primark shared 14% of its visitors. This is second only to Fat Face (16%) in Joules’ main list of competitors. This is a notable transformation from pre-pandemic; the two brands shared less than 9% of its visitors in this period in 2018. This is perhaps symptomatic of consumer trends emerging from a pandemic and into a Cost-of-Living crisis.

The takeover from Next follows on from a similar trend in shared visitors. In this period in 2018, Joules and its new owner shared 4% of its visitors, compared to 11% last week.

Consumers preference for Next and Primark has come at a cost to others. Joules’ main competition has shifted to these two brands whilst Jack Wills, Cath Kidston and White Stuff have struggled to retain their share. Fat Face is the only mid-range clothing retailer to notably increase its shared visits with Joules.

Dwell time in Joules’ stores has increased by 4% – perhaps refuting suggestions made in our CCI last week that consumers’ spending is now more intentional. It is likely that a surge in press for Joules last week has helped attract consumers.

Whilst footfall has stayed strong, rising freight costs, stock delays and labour shortages mixed with the bleak economic outlook created what looked to be terminal problems for the brand – particularly as the middle-classes started to tighten their purse-strings this year.

It has been saved from extinction in the new year, but will an injection of cash from Next help Joules better exploit its strong-looking footfall? Only time will tell.