Beyond Tradition: How Black Friday is Reshaping UK Christmas Shopping Trends

The convergence of Black Friday and the holiday season is causing a significant shift in consumer behaviour as shoppers adapt to the ongoing cost of living crisis. As the festive season approaches, consumers are strategically modifying their Christmas shopping habits to make the most of Black Friday deals and ease the financial burden associated with the holidays.

Early Christmas Shopping:

Black Friday, once a distinct US tradition of deals being offered on a single day in mid-November, has developed over the years to merge Black Friday and the January sales into one long winter discount period, with November firmly establishing itself in the UK as the unofficial start of the Christmas shopping season.

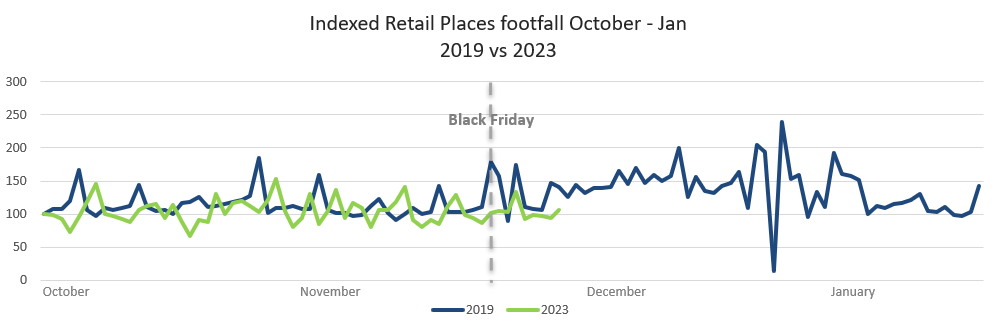

In 2023 the peaks in footfall we saw in 2019 have somewhat flattened out, with more visits to retail across the UK in the weeks before Black Friday than Black Friday itself.

In 2022 we saw shoppers favour the early discount period prompting a drop in retail footfall in early December. With retailers accommodating by beginning their discount period earlier and earlier, it looks like shoppers now plan to do their Christmas shop in early November. In fact, John Lewis recently made headlines by opening their online Christmas store a week early in response to a significant increase in searches for festive items compared to the previous year. This early consumer enthusiasm may be seen as a response to the prevailing cost of living crisis, which is driving consumers to be more cost-conscious.

Early signs of a December decline:

Consumers are recognizing the financial benefits of an early start to their Christmas shopping. Stubborn inflation, rising interest rates, and a reduction in spending power have led many Brits to cut back this year. Shopping early has become a way to spread the cost of Christmas over a longer period, making it more manageable, allowing them to make the most of early deals, seek out the best discounts, and, crucially, spread the cost of Christmas over several pay checks. This has bought a positive boost to footfall in early November. However overall, footfall across all retail locations was down -2.2% from 2022 and -12.7% since pre-pandemic levels.

In 2022 we saw a dip in footfall in early December and it seems likely that any positive increase in early November might yet again inversely negatively impact retail footfall in December.

Increase in Spending Power (but where is the spend?):

In the past, Black Friday visitors have been characterised as a lower to mid affluence consumer, but in 2023 this is no longer the case, discounts and deals are being sought by shoppers within higher income brackets. Now over 1/3 of Black Friday shoppers earn over £50k.

The increased potential spending power of visitors does not seem to correlate with an increase in spend. The BRC reported an increase of 2.7% in retail spend last month, well below the 4.2% rise a year ago, and similar to the 2.5% increase in October.

The intersection of Black Friday and the Christmas shopping season seems to have instigated a significant shift in consumer habits. All consumer types, driven by economic challenges, are increasingly opting for a discounted Christmas.

This year we are continuing to track the High Streets of the busiest cities across the UK – identifying which cities have recovered post Covid and which have fallen behind. You can download last years data for free.

Our Festive series this year started with deep analysis of past year’s data providing some predictions that we will further compare with real time data. Click here to read our trading predictions…